Millennials and Teens

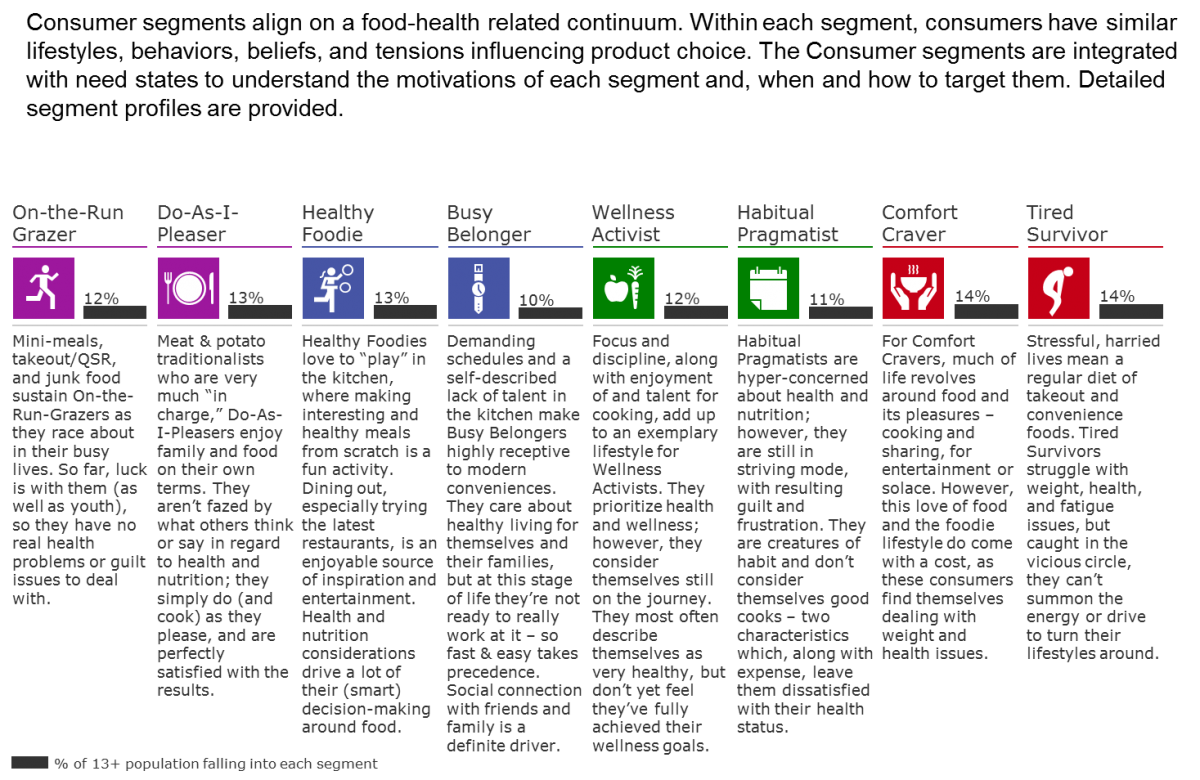

Millennial consumer segments

Millennial segments can be viewed in terms of their life stage: as they have children of their own, their focus shifts away from their own needs to concern about others.

As a group, Millennials are more likely than older consumers to be adventurous about food, eat on the run and graze, rather than eat full meals, be youthfully carefree about long term health and be social and socially connected. Within this group, we do see distinct segments emerge on other factors influencing food and beverage choices and habits.